Charitable Gift Annuities

A charitable gift annuity (CGA) is an example of how our current tax laws provide special ways for you to make a substantial gift of cash or stock and increase your income in the process. A CGA may offer a win-win proposition for you and the College.

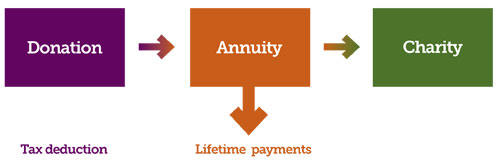

The CGA makes it possible for you to receive higher returns on an asset for the rest of your life. You will receive an immediate tax deduction for a portion of your gift and no capital gains tax will be due at the transfer of appreciated assets to your gift plan. Rates are based on the age of the "annuitant" and are typically fixed at a higher percentage as the age of the annuitant increases.

Rates on CGAs fluctuate in accordance with the insurance industry's "annual age calculations." Therefore, every CGA is individually customized. Once your CGA is established, you'll enjoy the benefits of membership in the Harold Johnson Society.

For an illustration of how a charitable gift annuity can work for you, please contact us.

Benefits:

- An immediate income-tax charitable deduction for a portion of your gift

- No capital gains tax due for the transfer of appreciated assets to your gift

- The potential of earning fixed payments for life (a portion of which may be tax-free) or receiving an increase in income earned from investments