Understanding Your Financial Aid Offer

Congratulations on your acceptance to Hampshire!

Our financial aid office will provide you with the best financial aid offer based on your submitted financial documents. The information below is intended to help you and your family understand the resources available to make your education affordable.

We are glad to partner with you and your family to ensure you are informed and confident in your admissions decision. Please don’t hesitate to contact our office with any questions:

Email: financialaid@hampshire.edu

Phone: 413.559.5484

We are here to help.

Financial Aid Eligibility

If you are eligible for federal and/or institutional financial aid, you will receive a notification from the financial aid office describing your offers. This notification will be sent via email and will direct you to explore.hampshire.edu/apply/status. There you can click on the My Financial Aid link; the My Award Letter tab will list your financial aid offers.

Applicants living in the U.S. will also be sent a paper financial aid offer letter in the mail.

For more information, see Your Financial Aid Notification.

Cost of Attendance and Financial Aid

Hampshire’s cost of attendance (COA) includes both direct costs (expenses billed to you and directly paid to the College), and indirect costs (expenses not billed to you but incurred as a result of attendance that the student/family may pay). The COA includes tuition and fees, books and supplies, housing, food, transportation, federal loan fees, and other miscellaneous expenses. For more information, see Tuition and Fees.

Once you have completed the necessary financial aid application and any supporting documentation requested, your level of need is determined. “Need” is the difference between the cost of attendance and the expected family contribution. Total aid including grants, outside scholarships, parent tuition benefits, work study, and loans cannot exceed the student's cost of attendance.

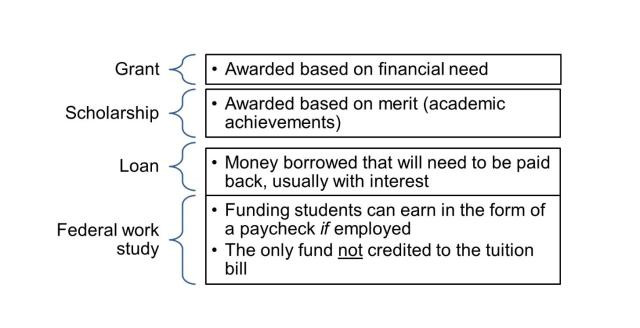

Your offer may contain any of these four different forms of financial aid:

These forms fall into two categories:

Gift aid: Includes grants and scholarships, which are outright gifts that do not need to be paid back. These could consist of:

- A Hampshire Grant, which is funded out of Hampshire's general revenue and by private gifts designated for financial aid.

- A Hampshire Merit Scholarship.

- Federal and/or state grants.

- Outside grants or scholarships from local organizations, high schools, state education agencies, and civic and social organizations in your home area.

- Parental and/or student-employer tuition benefits.

For most students, their initial total amount of gift aid remains the same throughout the academic year, so a change in the amount of any of the other gift aid components will result in an adjustment to a Hampshire Grant.

For example, if the Federal Pell Grant is increased, the Hampshire Grant will be decreased by the same amount; if a student is awarded a Merit Scholarship through the admissions office, the Hampshire Grant will be reduced by the amount of the Merit Scholarship. Students will receive a revised financial aid offer emailed to them if any changes occur.

Self-help aid: Includes loans and federal work-study employment.

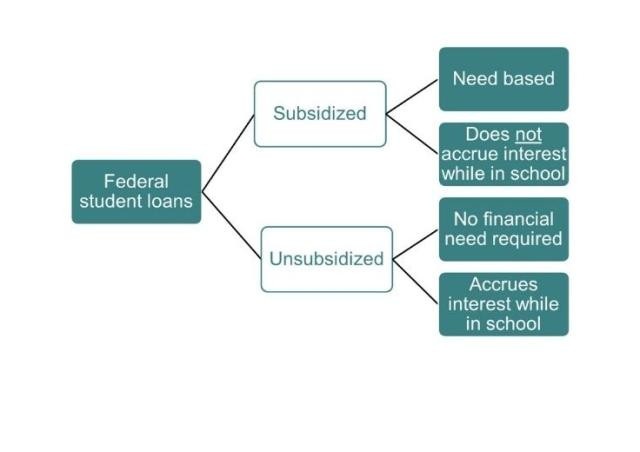

- A student loan recommendation is a federal loan that must be repaid with interest after enrollment at Hampshire ceases. A federal student loan can be subsidized or unsubsidized:

The suggested loan level will increase each year as students advance toward their degrees. Students may decline the loan portion of their awards, but the Hampshire Grant will not increase to compensate for the declined loan.

Students who decline the recommended loan are not eligible for other kinds of Hampshire grant assistance including any additional aid awarded as a result of an appeal.

- A federal work-study employment opportunity, if eligible, is income received directly by the student in exchange for work at the College. Students may work up to seven hours per week; the wage rate is $15 per hour for most positions.

Students may decline the work opportunity, but the Hampshire Grant will not increase to compensate for it. For more information see the Student Employment Office page.

Please reach out with any questions!